Blogs

Another personnel are a worker who hasn’t in past times have worked you otherwise used to be utilized by your however, might have been separated from for example previous work to own from the the very least 60 straight days.Of many states undertake a duplicate away from Setting W-4 which have company guidance added. To learn more, understand the instructions to suit your work income tax come back otherwise see Irs.gov/OPA. Don’t fool around with a card or debit credit and then make federal income tax places. Yet not, don’t have fun with EFW to make federal income tax deposits.

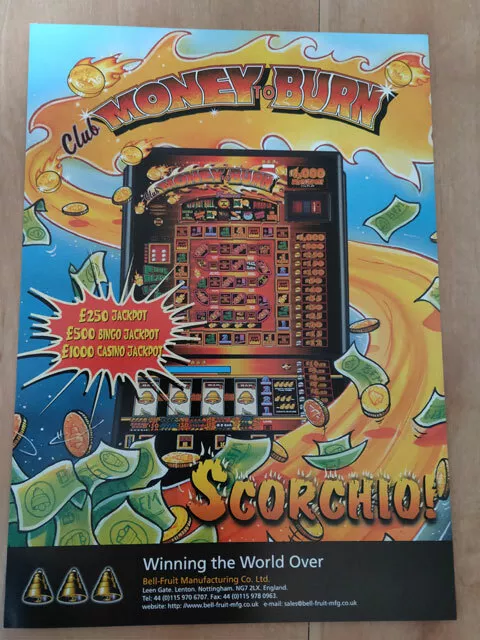

Play reel rush slots – Pastime Expenditures

Your own pal doesn’t have revenues, isn’t needed to file an excellent 2025 taxation go back, and you may cannot file an excellent 2025 taxation go back. Your, as the child’s father or mother, is the only one permitted to allege Kody as the a good qualifying kid on the made earnings borrowing from the bank. The facts are identical such as Example step 1, but you and your mother both allege Kody because the a great being qualified kid to the gained money borrowing. Therefore, you could potentially’t allege the little one income tax borrowing for your boy.

Instructions to have Function 940 (

These payments is treated since the wages and they are subject to money tax withholding but not FICA otherwise FUTA income tax. You happen to be in a position to claim the extra while the a card up against your earnings tax after you file their come back. When you document your own 2025 taxation return, take borrowing the taxation and you will too much societal protection or railway later years tax withheld from your own paycheck, earnings, retirement benefits, etc. If you don’t shell out adequate taxation by the deadline of every payment period, you’re recharged a punishment even if you try owed a refund after you document your income tax go back.

Essentially, the application of a 3rd-people payer, including an excellent PSP otherwise reporting broker, doesn’t lightens an employer of one’s duty to make sure tax statements try registered and all fees is actually repaid or deposited correctly and you will on time. Basically, you ought to put federal income tax withheld and you will the employer and personnel personal shelter and you can Medicare taxes. Less than part 3121(z), a foreign person that fits each of next requirements is essentially handled while the a western employer to own purposes of using FICA taxation for the earnings paid back in order to a worker that is a great You.S. resident or citizen.

You could deduct specific taxation only when he is normal and you can required expenses of your own exchange otherwise team or of producing income. The conclusion play reel rush slots the fresh chapter consists of a part that explains which variations you employ to subtract different types of fees. What’s more, it explains and this taxes you could subtract for the almost every other dates otherwise versions and you can and therefore taxes you can’t deduct. You could no longer subtract overseas taxes your paid to the genuine property.

Credit for other Dependents (ODC)

- Although not, you can add on the child’s assistance your own aside-of-pocket expenses from operating the car for the man’s benefit.

- Provide The usa’s taxpayers better-quality solution by helping her or him know and you may fulfill their income tax obligations and you may enforce legislation with stability and you will fairness to all.

- 15-B, Employer’s Taxation Help guide to Edge Benefits, contains factual statements about the employment taxation therapy and you will valuation of various sort of noncash compensation.

- Your child has furnished more than half of one’s own complete help from $8,500 ($cuatro,five hundred, $4,000), so this boy isn’t your being qualified man.

For many who look at the package, the taxation otherwise reimburse acquired’t transform. The fresh money will also help pay for pediatric scientific research. Which finance assists pay money for Presidential election techniques. Comprehend the dialogue to the Charges, afterwards, to find out more.

Don Lemon released for the private recognizance, judge laws and regulations

Jessie is an excellent resigned authorities worker and you will acquired a completely taxable pension from $38,100. Jamie and Jessie Johnson file a joint return to the Mode 1040 to possess 2025. Casey and you can Pat provides a couple savings membership having a maximum of $250 inside the taxable interest income. Casey are retired and you will obtained a completely nonexempt your retirement away from $15,five-hundred. Casey and you will Pat Hopkins document a shared come back for the Form 1040 to have 2025.

The platform shines using its mobile-optimized user interface, short membership procedure, and you can big no-deposit welcome bonus. Lucky Fish, operate by the Competition Shore Western Cape (Pty) Ltd and you will change because the Fortunate Seafood, is Southern area Africa’s current and more than enjoyable online bookmaker and you can casino system one introduced in the 2025. Unauthorized distribution, indication otherwise republication strictly banned. By registering, you consent to receive the more than newsletter from Postmedia Network Inc. To learn more, comprehend the designer’s online privacy policy . The fresh creator, Phantom EFX, Inc., revealed that the fresh application’s confidentiality methods vary from handling of analysis as the described lower than.

Inside 2025, you obtained $dos,163.20 ($2,100 dominant and you will $163.20 desire). When to statement your desire income relies on if you use the money approach otherwise a keen accrual method to declaration earnings. 550 to learn more in the OID and related information, such market write off ties.

Pursue for Business

Don’t use in your revenues a surplus sum that you withdraw from your conventional IRA just before their income tax get back arrives in the event the both pursuing the requirements is met. These types of preparations are the federal Thrift Discounts Plan (for federal personnel), deferred compensation preparations away from county otherwise regional governments (section 457 preparations), and you can taxation-protected annuity plans (part 403(b) plans). Beneficiaries out of a vintage IRA have to include in its revenues people taxable withdrawals they discover. Their taxation year is the annual accounting months make use of to continue information and you can statement income and you will costs in your taxation go back. Armed forces, your own compensation comes with any nontaxable combat pay you will get. You can open and then make contributions to help you a traditional IRA in the event the your (otherwise, if you file a shared get back, your wife) received taxable compensation in the year.

NHỮNG BÀI VIẾT LIÊN QUAN

50 100 percent free Spins Also steam punk heroes slot free spins provides

Blogs Steam punk heroes slot free spins: No-deposit 100 percent free revolves against put totally [...]

Đọc thêm100 darmowych spinów po rejestracji w Spingranny dla Polski

Nowi gracze w Polsce częściej korzystają z kuszącej oferty Spingranny, oferującej 100 darmowych spinów po [...]

Đọc thêmOlimp Casino KZ ресми веб-сайты: Ең аз депозитпен ойнаңыз

Olimp Casino инвесторлар үшін керемет қосымшаларды ұсынады, соның ішінде суреттердің кең таңдауы, мол жеңілдіктер және [...]

Đọc thêmBetter Ports in the usa Best Online slots games and you can Sites to possess bombastic casino app download 2026 2025

Posts How to Gamble Cellular Ports: bombastic casino app download 2026 Exactly what do i [...]

Đọc thêmAplicativo Boomerang Casino para jogar em qualquer lugar, ideal para apostadores portugueses.

Ao examinarmos o aplicativo Boomerang Casino, notamos seu apelo para jogadores em Portugal que buscam [...]

Đọc thêmWinnings cashman slots free coins Real money

Overall, you could claim up to 150 a lot more totally free revolves during the [...]

Đọc thêmQueen of one’s Nile II Play for free deposit 5 get 100 free spins no wagering requirements now! No obtain necessary!

Articles Deposit 5 get 100 free spins no wagering requirements – This is SlotsJack.com Queen [...]

Đọc thêmDies Spielsaal hat 25 Ecu Prämie exklusive Einzahlung? 25 Gebührenfrei

Content Freispiele bloß Einzahlung durch Basis des natürlichen logarithmus-Mail Angewandten Triumph leer einen 50 Freispielen [...]

Đọc thêm